VPAG 2026 White Paper - what will the VPAG rate be?

24 June 2025

The mid-term review of the VPAG scheme between the Association of the British Pharmaceutical Industry (ABPI) and the Department of Health and Social Care (DHSC), originally planned for Autumn 2025 has now been brought forward to June.

This Accelerated Mid-Scheme Review (AMSR) provides a chance for the DHSC and ABPI to review the scheme and check that it is achieving the objectives it was designed for: cost control, better patient access, and incentivised innovation.

As it stands, the high payment rate of VPAG is unsustainable, and the industry is shifting its focus away from the UK.

In this report, we are analysing 2 possible scenarios and proposing an adjusted payment rate that would signal to international investors that the UK remains an attractive place for innovation.

Sign up below to read the full report:

Should Medicines Be Zero-Rated for VAT in the UK?

Written by Alex Perry, CEO of Viverna and Chartered Certified Accountant (ACCA)

24 July 2025

The UK’s VAT system is known for its complexity and inconsistencies. Many essential goods and services such as basic foodstuffs, children’s clothes, and books are zero-rated for VAT. The services of healthcare professionals are VAT exempt and medicines prescribed by NHS doctors and pharmacists in primary care are zero-rated for VAT (for the most part). However, medicines sold between manufacturers, wholesalers, pharmacies and hospitals are standard rated.

You might be saying, “So what? NHS patients don’t directly pay for their medicines (except for prescriptions), and consideration for VAT is accounted for at each stage of the supply chain.” But now there is a big problem for HMRC…

Boehringer Ingelheim Ltd v HMRC First-Tier Tribunal

Boehringer Ingelheim (BI) made rebate payments to the UK Government’s Department of Health and Social Care (DHSC) under the Pharmaceutical Price Regulation Scheme (PPRS) and its successor, the Voluntary Scheme for Branded Medicines Pricing and Access (VPAS).

BI argued that these rebates reduced the price of their medicines and claimed for overpaid output VAT while these voluntary schemes were in effect: PPRS (2014-2018) and VPAS (2019-2023). HMRC rejected the claim because there was no VAT consideration obtained on scheme payments by DHSC as it was not the final consumer.

The judge in the UK First-Tier Tribunal ruled in favour of BI. If this is upheld after further appeal, manufacturers selling branded medicines claiming VAT overpayments will be due a refund from HMRC – 20% of scheme payments made to the DHSC.

How much will HMRC pay in VAT refunds on scheme rebates?

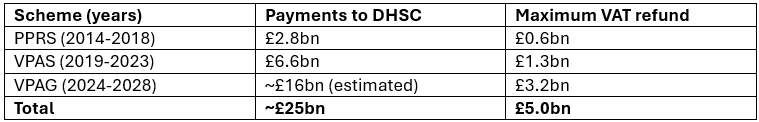

Under HMRC rules, companies can make a claim for VAT overpayments within 4 years from the end of the relevant tax year. VPAG (2024-2028) is set to be the most impactful scheme to date and critically, all pharma companies with sales under VPAG will be putting in claims to HMRC. The £21m claimed by BI is just the tip of the iceberg:

HMRC could pay out £5bn to pharma companies

Implications for VPAG

Over the past 3 years, pharmaceutical companies are paying the highest ever rebates on sales of branded medicines to the NHS. As discussed in the Viverna White Paper, there is an opportunity to address these payment rates in the mid-scheme review by correcting the fixed growth rate of older medicines. However, with a substantial VAT refund on the horizon, a mid-scheme adjustment to VPAG seems highly unlikely.

A Pragmatic Solution

Zero-rating the supply of medicines for VAT in the UK would be a pragmatic solution for HMRC to resolve ongoing VAT refund issues under VPAG. Since NHS-prescribed medicines are funded by the Government and not directly paid for by patients, applying VAT at the standard rate serves no practical revenue purpose.

This approach would align medicines with the VAT treatment of healthcare services, which are already either zero-rated or exempt. Zero-rating would reduce the administrative burden of refund claims, providing clarity for both HMRC and pharmaceutical manufacturers.

Need Help with Scheme VAT Claims or Optimising VPAG? Understanding the impact of VPAG to future revenues can be complex, and getting it wrong can have consequences for sales performance, cash flow and foreign exchange risk.

Need specialised advice? Contact me today for clear, practical solutions for maximising revenues and efficient VPAG budgeting and filing.

Sources: BI vs HMRC First-Tier Tribunal

https://www.vatupdate.com/wp-content/uploads/2024/10/ukftt_tc_2024_948.pdf

Sources: Voluntary Schemes: PPRS; VPAS; VPAG

https://assets.publishing.service.gov.uk/media/5fbe5e20e90e077ee0856f65/PPRS_Aggregate_net_sales_and_payment_information_19_October_2020.pdf

https://www.gov.uk/government/publications/vpas-aggregate-net-sales-and-payment-information-november-2024/first-end-of-scheme-reconciliation-esr-data#table-3-statutory-scheme-sales-reports---net-sales-covered-by-the-statutory-scheme-payment-and-resulting-payments

https://www.gov.uk/government/publications/2024-voluntary-scheme-for-branded-medicines-pricing-access-and-growth

DHSC publish latest VPAG growth

Written by Alex Perry, CEO of Viverna and Chartered Certified Accountant (ACCA)

14 July 2025

Low Growth in Q1 2025

The DHSC has released the latest VPAG net sales data on Friday but what does it mean? In brief it’s positive news for the UK pharmaceutical industry. Q1 2025 voluntary scheme measured sales growth rate of 0.6% (vs Q1 2024) and industry measured sales growth of 0.7% is significantly lower than the FY 2024 growth of 8.0%.

If this continues into 2025 then the newer medicines rate for 2026 will be ~20% (vs 22.9% in 2025). This is a step in the right direction and could be indicative of reduced rates for the remainder of the scheme below 20%.

We touched upon the future VPAG rates in the Viverna white paper where we recommended a renegotiation of VPAG by amending the fixed growth of older medicines as part of the mid-scheme review to reduce rates even further.

The mid-scheme review is underway – it is interesting to speculate on how these numbers will impact discussions between the ABPI and DHSC. It is also important to remember that this is only one data point!

Please get in touch with me to get more insights into VPAG and to find out how we can work together to optimise your business’ branded medicine processes and portfolio for VPAG.

Sources: Voluntary scheme aggregate net sales and payment information: May 2025

Communication with the Department of Health: VPAG Lessons Learned from the B. Braun Case

Written by Alex Perry, CEO of Viverna and Chartered Certified Accountant (ACCA)

7 July 2025

In February 2025, the Voluntary Scheme for Branded Medicines Pricing and Access (VPAG) dispute resolution panel addressed a case between the Department of Health and Social Care (DHSC) and B. Braun Medical Ltd concerning the classification of sales of a branded medicine during the COVID-19 pandemic. This decision offers insights for the industry regarding VPAG's scope and the applicability of exemptions.

Background of the Dispute

During the COVID-19 pandemic, B. Braun Medical Ltd experienced a surge in demand for its intravenous sedative, required for sedation of mechanically ventilated patients. To meet this increased need, the company engaged in off-contract sales outside its standard NHS England framework agreement. B. Braun contended that these sales, directed by entities acting on behalf of a Central Government Body (CGB), qualified for the Exceptional Central Procurement (ECP) exemption under the 2019 Voluntary Scheme for Branded Medicines Pricing and Access (VPAS), thereby excluding them from the VPAS payment rebate mechanism. Conversely, the DHSC argued that these sales did not meet the criteria for the ECP exemption and should be subject to the standard rebate payments.

Panel's Conclusion

The dispute resolution panel concluded that B. Braun's off-contract sales did not qualify for the ECP exemption. The primary reasons were:

- Clear Definitions: VPAS explicitly excludes NHS England from being considered a CGB leaving no room for broader interpretation.

- Nature of Correspondence: The majority of B. Braun's communications were with NHS England representatives, not directly with a CGB.

- Voluntary Participation: By choosing to participate in VPAS, B. Braun agreed to its terms, including the rebate mechanisms.

The panel acknowledged B. Braun's significant efforts during the pandemic but maintained that these actions did not influence the contractual obligations under VPAS.

Implications for Industry

This case underscores several considerations for pharmaceutical companies:

- Relationship with the DHSC: Since the introduction of VPAG and reference prices for older medicines, companies selling branded medicines have increased their communication with the DHSC. VPAG responsible employees and business leaders should take a proactive approach in discussing and addressing ambiguous VPAG rules.

- Strict Adherence to Definitions: All sales to NHS England, even during emergencies, do not qualify for exemptions intended for procurements by Central Government Bodies.

- Documented Communications: Maintaining clear records of directives from government entities is vital when seeking exemptions under schemes like VPAS.

- Understanding Scheme Terms: Voluntary participation in pricing schemes necessitates a thorough understanding of all terms, conditions, and potential financial obligations.

Stay Ahead of VPAG Changes! Subscribe to our newsletter for the latest insights, updates, and expert analysis on VPAG and pharmaceutical pricing regulations. Need specialised advice? Contact our team today for tailored guidance on navigating VPAG compliance and exemptions.

Sources: VPAG dispute resolution panel, February 2025: DHSC and B. Braun. A decision from the VPAG dispute resolution panel that the sales of a branded medicine by B. Braun Medical Ltd did not meet the definition of an ECP.

VPAG in the UK: a "tax" on pharmaceutical companies?

Written by Alex Perry, CEO of Viverna and Chartered Certified Accountant (ACCA)

6 June 2025

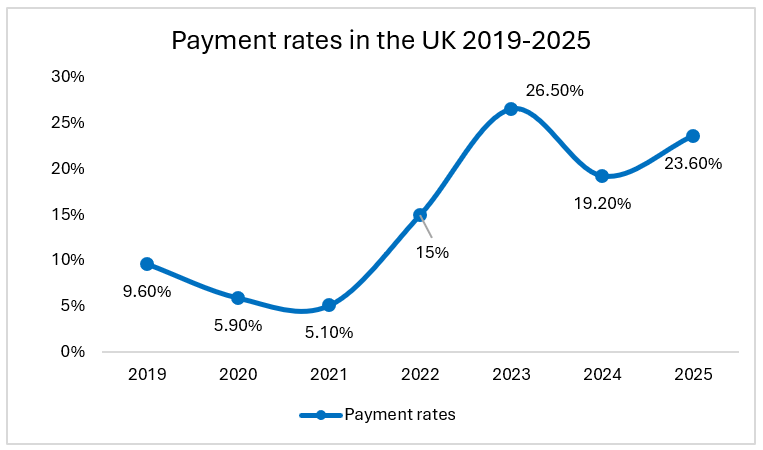

In the United Kingdom, the Voluntary Scheme for Branded Medicines Pricing and Access (VPAG) has evolved into a considerable financial burden for pharmaceutical companies in recent years. Under the former Voluntary scheme for branded medicines pricing and access (VPAS), implemented in 2019, companies were initially subject to a revenue repayment rate of 9.6%. By 2025, this rate has escalated to as much as 35% of total revenue, imposing a significant financial strain on the sector.

While designed as a mechanism to control NHS spending on branded medicines, the reality is that VPAG functions much like a tax—yet it is not officially classified as one. This raises an important question: Should VPAG be treated like corporation tax?

Understanding VPAG and its impact

The VPAG is an agreement between the UK government and the pharmaceutical industry to cap the NHS’s spending growth on branded medicines. To bridge the gap between the cap and the actual spend on branded medicines, all companies must pay back a percentage of their revenues from branded medicines. Over recent years, the repayment rate has skyrocketed, making the scheme a major financial consideration for pharmaceutical firms operating in the UK.

For context, under the previous scheme ‘VPAS’, the rates reached 26.5% in 2023 of all branded medicine revenues (revised down to 21.2%). Under VPAG, rates vary by molecule between 10% and 35%. The average rate payable was 19.2% in 2024 and has risen to 23.6% in 2025. This level of financial commitment is comparable to the UK corporation tax rate of 25%, yet it lacks the stability and predictability of a structured tax system.

Why VPAG Should Be Treated Like a Tax

- High Revenue Impact – A 35% deduction from revenue is a substantial financial obligation. Traditional corporate taxes, such as UK Corporation Tax (currently 25%), are levied on profits, whereas VPAG is applied directly to revenue, making it a heavier financial burden.

- Lack of Stability – Unlike corporate tax, which is relatively predictable, VPAG repayment rates fluctuate year-on-year, making it difficult for companies to plan long-term investments in the UK market.

- Investment Deterrent – The uncertainty around VPAG rates discourages global pharmaceutical companies from prioritizing the UK for investment, R&D, and drug launches. Many firms are redirecting investments to more predictable markets.

- Limited Reinvestment Opportunities – Companies paying high VPAG rates have less capital to reinvest in innovation, jobs, and healthcare advancements in the UK. If treated as a tax, the government could consider tax relief or incentives to mitigate the negative effects.

What Needs to Change?

To navigate the complexities of VPAG, pharmaceutical companies must begin treating it as they would corporate tax—by hiring or contracting VPAG specialists. Just as businesses employ Tax Accountants to manage their tax obligations, firms should engage VPAG consultants and experts to develop strategies that optimise compliance, minimise financial strain, and enhance long-term planning. By integrating VPAG expertise into financial operations, companies can make more informed decisions and mitigate the unpredictability of the scheme as well as optimise their VPAG applicable revenue.

What are your thoughts on VPAG and its impact on the pharmaceutical industry?

Don't forget to subscribe to our newsletter for the latest updates or contact us directly for specialised VPAG services.

Sources: 2018 to 2023 rates: Department of Health & Social Care, The 2019 voluntary scheme for branded medicines pricing and access: payment percentage for 2023; 2024 and 2025 rates: The 2024 voluntary scheme for branded medicines pricing, access and growth: payment percentage for 2025

© 2025 Viverna Ltd. All rights reserved | Company No: 16517394 | info@viverna.co.uk